Contributor Articles

In just the last half year, climate change has supercharged some of the costliest disasters the U.S. has ever experienced. Hurricanes Helene and Milton and the Los Angeles wildfires caused hundreds of billions of dollars of damage that will take years to recover from and leave deep financial scars for families, businesses, and governments.

Employment discrimination is still a serious and persistent problem in the U.S. Over the last five years, more than 285,000 discrimination complaints have been filed with the Equal Employment Opportunity Commission by employees in our states alone.

The current administration has hit the ground running with policy changes designed to stymie shareholder engagement and corporate accountability, with particularly visible and harmful attacks targeting corporate progress on racial equity. Our opponents laid the groundwork for these actions through bills passed by the House of Representatives last Congress and Project 2025.

We are in an anti-democratic moment. People with money and power refuse to heed those who have neither. This is true in Washington. But, it is also true in statehouses where state officials try to intimidate into non-action and silence investors who believe sustainability is key to long-term investment success.

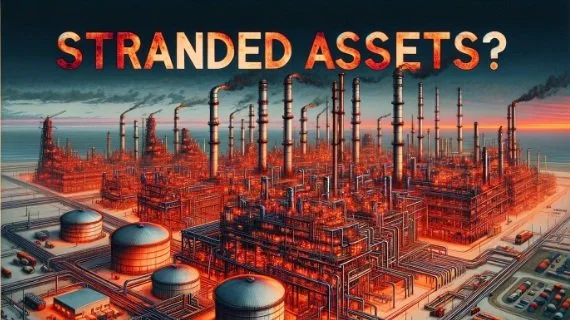

There is nothing “free market” about this effort. Instead, it is an attempt to bolster the fossil fuel industry at the expense of shareholder prerogatives.

In order to help companies and investors determine whether a shareholder proposal qualifies to appear on the proxy statement under SEC Rule 14a-8, the SEC has developed a process to allow companies to inquire in advance whether a proposal must be included. The “no action” process is an informal review process through which the SEC staff advises companies and their investors on whether the SEC staff would recommend enforcement action if a company fails to include a submitted shareholder proposal on its annual proxy statement.

An anti-shareholder movement – often mislabeled as “anti-ESG” – is silencing the voice of everyday investors in the U.S., including the 50% of private sector workers who participate in 401(k) retirement plans.

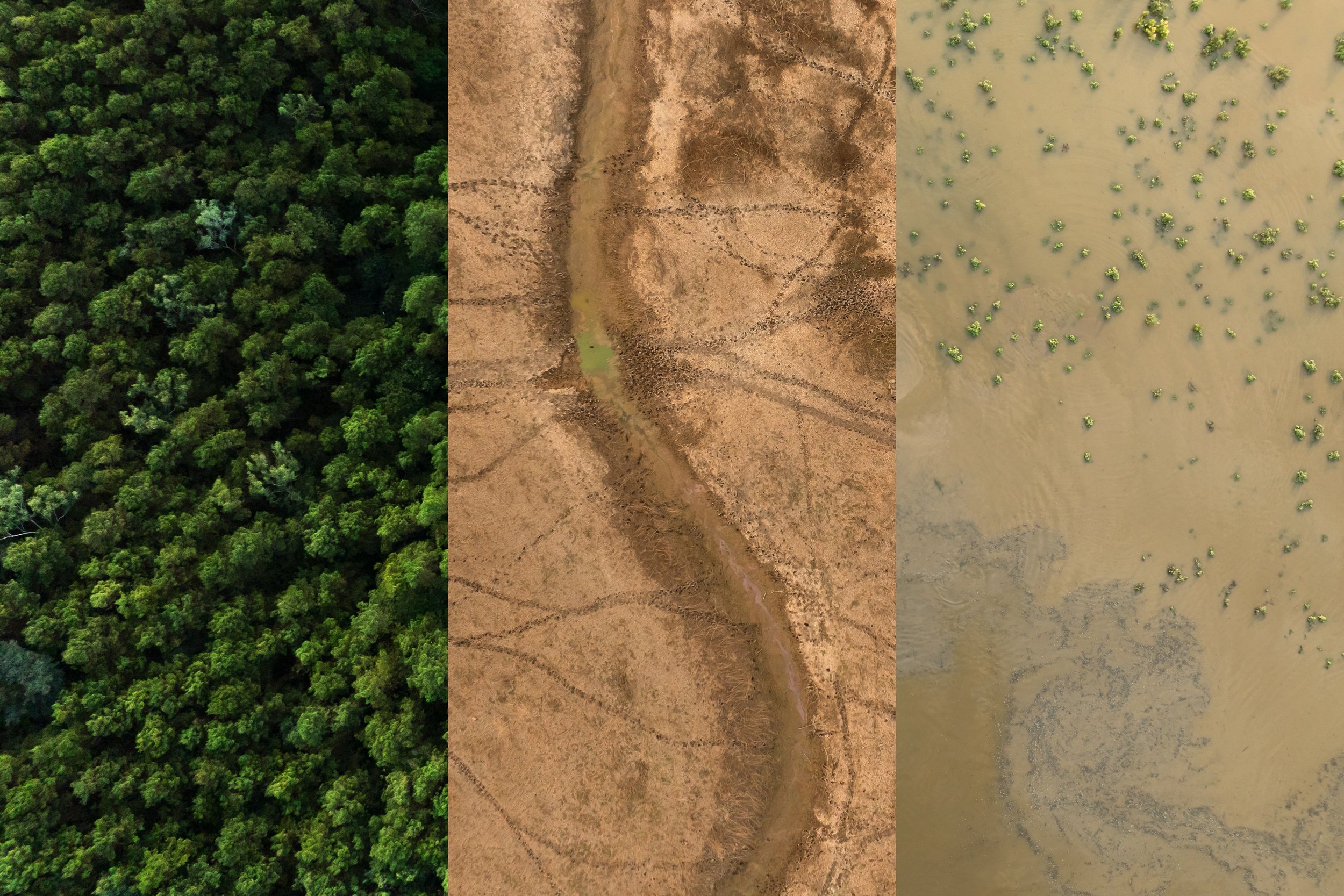

Global biodiversity is deteriorating faster than at any time in human history, largely due to human activity. Such massive biodiversity loss poses serious economic and financial risk as more than half the world’s economy is moderately or highly dependent on nature. To reverse this trend, companies must start by meaningfully assessing, disclosing, and addressing their nature-related impacts, dependencies, risks, and opportunities.

The Net-Zero Banking Alliance (NZBA) formed in the spring of 2021 to great fanfare. Banks in the alliance made a voluntary commitment, signed by their CEO, to set and publish targets that are aligned with pathways for net zero by 2050, reduce emissions associated with their material financing activities in carbon-intensive sectors, and develop transition plans to achieve the targets.

The transportation sector is the largest source of U.S. greenhouse gas (GHG) emissions. Medium- and heavy-duty vehicles are the fastest-growing source of transport emissions, driven by the expansion of e-commerce and consumer demand for fast delivery. Trucks’ disproportionate impact on emissions and community health underscores the urgency of adopting cleaner, more efficient technologies and practices.

Flexible packaging is one of the fastest-growing packaging sectors and a major contributor to global plastic pollution. It is the second largest packaging segment in the U.S. after corrugated cardboard, valued at $63 billion, comprising 21% of the U.S. packaging market.

Insurance is the climate crisis canary in the coal mine, and the canary is expiring. Last year, insurers globally had a record $154 billion in natural catastrophe losses. In the U.S., insured natural catastrophe losses were a record $117 billion; 2025 is on track to be another record setting year, with the LA wildfires alone costing insurers an estimated $25 to $35 billion.

Scope 3, or value-chain emissions, account for an average of 75% of a company’s total greenhouse gas (GHG) emissions, rising to over 90% in the retail sector. While challenges persist in assessing Scope 3 emissions – including data availability and quality concerns – assessing these emissions is critical to any credible climate strategy. Only by acting to assess value-chain emissions will data quality improve.

In complex situations where environmental and human rights issues are not addressed by local regulation, shareholders can drive corporations to promote significant change by demanding more from their suppliers. This is evident in Mexico's avocado industry, where shareholder engagement, political action, and NGO efforts are tackling illegal deforestation and its impacts.

The year 2024 saw record-breaking global temperatures and extreme weather disasters worldwide, causing loss of life, homes, and hundreds of billions in damages. In light of this devastating year, investors are looking to the 2025 proxy season as an opportunity to encourage corporations to do more to address the financial impacts of climate change by reducing planet-warming greenhouse gas emissions and investing in the clean energy economy.

In recent years, the food service industry has been rife with workplace health safety issues. Food service workers have been attacked, stabbed, shot, and killed by customers in the restaurants where they work. According to one study, between 2017 and 2020, at least 77,000 violent or threatening incidents took place at California fast-food restaurants. Recent data indicate that the cost of workplace violence could be as much as $56 billion annually – and that’s likely an undercount. However, workplace health and safety issues are not limited to customer violence. Workers have also been made to work under unsafe and unsanitary conditions, such as restaurants with high kitchen temperatures and restaurants infested with vermin.

Since 2011, investors have filed over 600 shareholder proposals asking for lobbying disclosure reports that include federal and state lobbying amounts, payments to trade associations and social welfare groups used for lobbying, and payments to tax-exempt organizations that write and endorse model legislation. The proposal has been voted on at nearly 400 companies, produced more than 125 settlements for improved disclosure, and notched 13 majorities, including Exxon and McDonald’s.

The exponential growth of online child sexual exploitation, cyberbullying, and teen mental health issues is directly linked to the growth of social media. These negative impacts on children and teens are primarily due to algorithms designed to send streams of unsolicited materials that entice children into online engagements with strangers, exploit their personal data, and keep them online for longer periods of time at the same time that age verification features remain insufficient, enabling adults and children to pretend to be different ages – increasing the rates of child sexual abuse.

The widespread adoption of artificial intelligence (AI) by companies has the potential to unleash broad-based economic prosperity by enhancing employee productivity. But, it also carries risks to workers’ rights as AI algorithms increasingly set productivity quotas, make human resource decisions, and direct workers on how to perform their jobs. For example, the use of AI in human resources decisions can result in unlawful employment discrimination.

As the development, deployment, and use of artificial intelligence (AI) continue to grow at remarkable rates, the significant potential benefits of AI are mirrored by equally significant potential risks, such as disinformation and data insecurity.

President Trump’s DEI-related executive orders, and the implications they have on the private and corporate sectors, have caused disruption to longstanding employment practices. There have been concerns raised around the legality and risks of collecting and sharing data on a company’s workforce and utilizing that data to strengthen its human capital management strategies as it relates to its diverse staff. The concerns being raised may feel like new additions to the corporate reporting landscape; however, they are similar to what we heard from 2018 to 2020 around the EEO-1 disclosure form (a government-mandated form showing a company’s demographic workforce data by sex, race, and ethnicity).

The push for board diversity has gained momentum in recent years, in part as an acknowledgment that a board’s needs are changing in response to an increasingly complex, competitive, and dynamic operating environment. The advent of disruptive technologies, geopolitical shifts, and evolving consumer behaviors and expectations has compelled boards to adopt a more expansive approach to oversight, strategy, and widening the lens on the risks that could harm the company. Recent retreats by ISS, Vanguard, and others of a full-throated endorsement of board diversity should be viewed for what they are – a calculated risk mitigation strategy in response to the current political climate and recent legal decisions around diversity mandates. The factors that underpin a commonsense business case for demographic diversity on boards are as relevant as ever.

It’s head spinning to watch the second Trump administration unfold. Daily directives – many unlawful – from Washington have upended the nation. Grant freezes, proposed tariffs, mass deportations, and ending federal DEI programs; attempted dissolution of congressionally created executive agencies; and restrictions on shareholder proposals are overwhelming.

Don’t believe the conservative hype. The campaign against sustainable investing is a scheme propped up by special interest groups, shady billionaires, and the fossil fuel industry. It has no future among investors, fund managers or anyone who wants to protect their money from foreseeable risks.

In May 2023, the National Association of Manufacturers (NAM) successfully filed a motion to intervene in a federal case brought by the anti-ESG group the National Center for Public Policy Research (NCPPR) against the Securities and Exchange Commission (SEC), challenging a shareholder resolution No Action determination. The NAM motion opened a broader challenge to the SEC’s authority to provide guidance regarding whether shareholder resolutions could be allowed on a company’s proxy for a vote, claiming that this process violates principles of corporate First Amendment rights enshrined in the Citizens United ruling.

Over the past decade, the investor community has worked with hundreds of companies, regulators and investment organizations to address climate change. Why? Because cutting emissions is a prudent and effective business management strategy that reduces a host of risks

The modern administrative system was set up in recognition of the needs of a technologically developed society where the lives of citizens are affected by dozens and dozens of complex areas. From air pollution, to drugs, the internet, transportation, education, chemicals, railroads, airwaves, consumer protection, and health, agencies set the rules of the road for some of the most important areas of our lives.

This year proxy and shareholder proposal rules and practice are evolving to create greater accountability and efficiency. Simultaneously, so called anti-ESG efforts are pressing a more disruptive policy agenda that could eviscerate the rights of share owners to file and vote on environmental and social proposals.

My first serious introduction to the concepts and practice of “active ownership” and proxy voting came in the early 2000s as the director of a newly created family foundation, the Singing Field Foundation. At that time, I joined the Environmental Grantmakers Association and began attending its conferences and those of other environmental funder affinity groups. Earlier, as a college student, I was on the periphery of the campaigns around university endowments and investments in South Africa. And, I have always felt that mission-driven organizations with invested assets should take great care that those investments not be in conflict with the mission.

Natural gas proponents have long framed it as a “bridge fuel” for meeting rising energy demands, while decreasing utilities’ dependence on carbon-intensive coal. Unfortunately, the power sector is now more focused on extending the natural gas bridge than crossing it.

The pervasiveness of artificial intelligence (AI) appears to be inescapable – AI bots are integrated into smart phones; internet searches are completed by AI assistants such as by Alphabet’s Gemini AI model. What’s more, the market for AI products and services is predicted to grow – and fast.