THE 2018 PROXY SEASON

This section of the report presents information on all the social and environmental proposals investors have filed for the 2018 proxy season that have surfaced so far.* Additional proposals for spring votes will show up as the season progresses and a dozen or so more are likely to be filed for meetings that occur after June. About 30 proposals are included in the aggregate totals but are not described in detail since they have yet to be made public. Consequently, the Proxy Preview encompasses the vast majority of social and environmental resolutions that shareholders will raise in 2018.

Topic categories:

Information is presented in six different categories—Environmental Issues; Social Issues and Sustainable Governance, Ethical Finance, Other Governance and Conservative Groups. The first three sections comprise nearly all of the proposals and corresponds with environmental, social, and governance (ESG) categories commonly used by investors. Ethical Finance includes a few more that raise questions about ethics and probity in financial dealings. Other Governance highlights key governance issues, such as high CEO pay, being raised by the investor community that this report does not track but is of interest to many shareholders. Investors with a conservative perspective also file a few resolutions opposing ESG reforms and those are discussed separately.

Proposal details:

We note how many proposals have been filed in each category, which are now pending, how many have been withdrawn for tactical or substantive reasons after negotiated agreements with companies, and the disposition of challenges to the proposals at the Securities and Exchange Commission (SEC) under its shareholder proposal rule. Rule 14a-8 of the 1934 Securities and Exchange Act allows companies to omit proposals from their proxy statements if they fall into certain categories such as dealing with “ordinary business” issues. (See box, right, for a link to a page online with more details on the rule.) The analysis focuses on the resolved clauses and how these compare to previous proposals. The report notes previous support if a resolution has been resubmitted and identifies new developments. We pay special attention in 2018 to potential reinterpretations of the omission rules, given the release on Nov. 1, 2017, of SEC Staff Legal Bulletin 14I, which set out new views on how the SEC may assess whether a resolution concerns “ordinary business” or is “significantly related” to company business.

Key information—Within each section, at-a-glance information is presented in tables that list each company, the resolution, the primary sponsor and the projected month for each company’s 2018 annual meeting, based on last year. Confirmed dates will become available to investors in their proxy statements, which companies issue four to six weeks in advance of their annual meetings.

Voting eligibility—To vote on proposals, investors must own the stock as of the “record date” set by the company, about eight weeks before the meeting. Companies provide this date in each proxy statement.

Proponent and expert commentary:

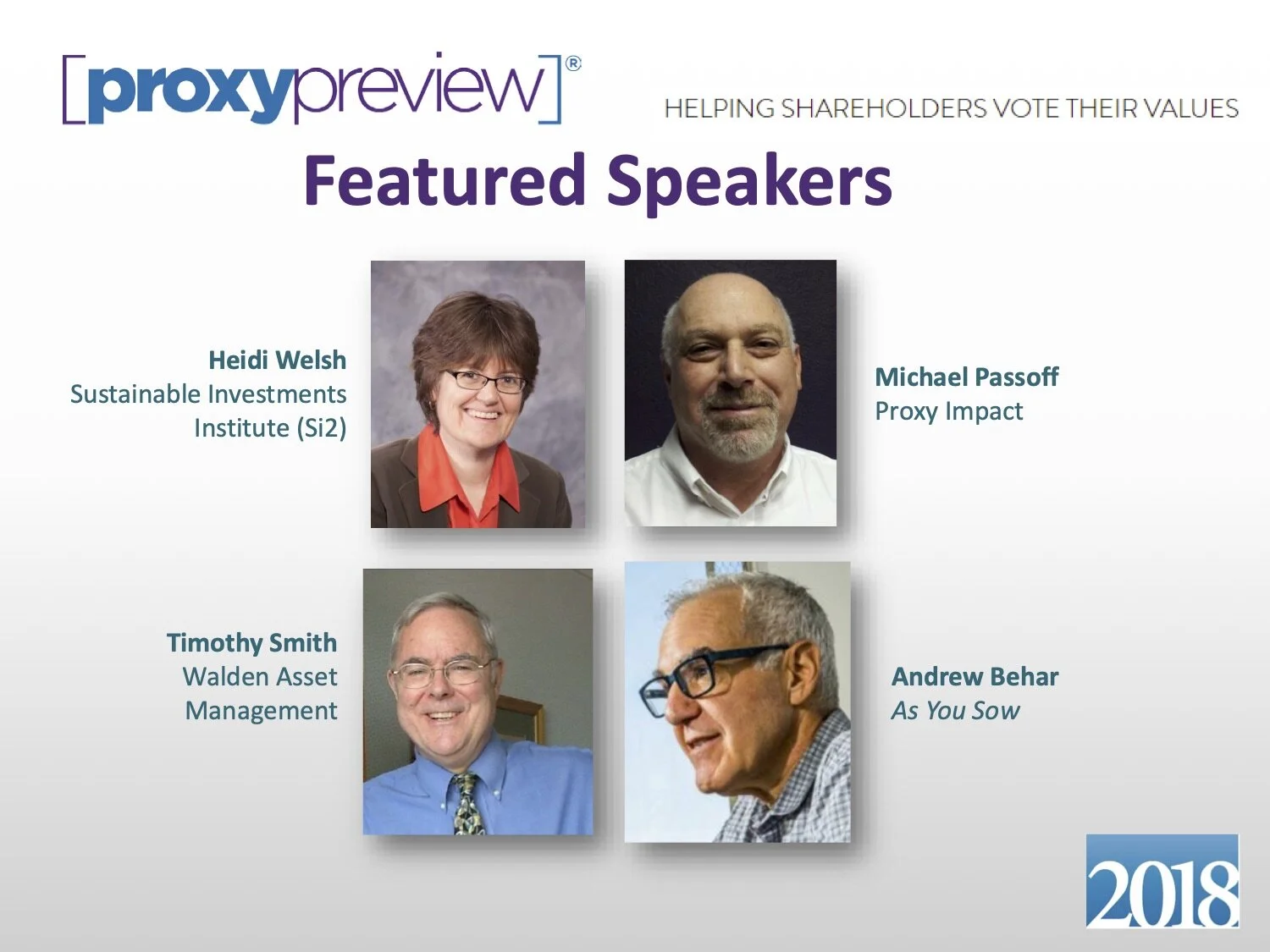

Additional insights, information and opinions from 38 experts in the field and shareholder proponents appear throughout the report.

Expert Insight: The Proxy Voting Landscape is Changing

*Not included in this tally are proposals filed by the New York City Comptroller’s office asking for the right to nominate directors using the company proxy statement—known as “proxy access.” These proposals are prompted by social, environmental and governance concerns but their inclusion is beyond this report’s scope. Some resolutions asking about executive pay clawbacks after opioid-related settlements, and for independent board chairs, also are not included in this report.