It sure sounds like a new era has dawned! The World Economic Forum recently issued a new manifesto and the Business Roundtable (BRT) released a new statement on the “Purpose of a Corporation.” Both declare that a new business model has been adopted and it is Stakeholder Capitalism, where “a company serves not only its shareholders, but all its stakeholders—employees, customers, suppliers, local communities and society at large” including sustainable environmental, social and governance (ESG) principles. However, are we really in a new era? Do the titans of business finally understand and agree to the essence of what shareholder advocates have been asking for since the first social policy resolutions were filed 50 years ago? Or are these just empty words?

Read moreExecutive Summary

Proponents have filed at least 429 shareholder resolutions on environmental, social and sustainable governance issues for the 2020 proxy season, up from 366 filed at this time in 2019. A total of 322 were pending as of February 21. Securities and Exchange Commission (SEC) staff have allowed the omission of 26 proposals so far in the face of company challenges; companies have lodged objections to at least 63 more that have yet to be decided. Proponents have already withdrawn slightly more proposals than they had last year at this time—78, compared with 71 in mid-February 2019 and 62 in 2018. Withdrawals generally indicate that the proponents and management have reached an agreement.

Read moreIntroduction

This section provides a look at the main issues raised in each of the topics covered in this report, giving special attention to new issues and also company efforts to block proposals under SEC rules. Hanging over the proxy season this year are proposed controversial rule changes that are likely to have a significant impact on future proxy seasons, although they would come too late for this year. (See Executive Summary above and SEC Proposed Rules Changes (p. 14) for more on the proposed rule changes.)

Read moreSEC Proposed Rule Changes

The SEC has received nearly 20,000 comments from investment firms, pension funds, organizations, and individuals–representing over $1 trillion in assets under management–in opposition to its proposed rule changes. Four leaders of the shareholder rights’ movement help explain the impact of the new rules.

PROPOSED RULES THREATEN TO OBSTRUCT PATHWAY TO IMPROVED ESG DISCLOSURE AND PERFORMANCE

SANFORD LEWIS

Director, Shareholder Rights Group

The Shareholder Rights Group includes leading shareholder proponents working to defend SEC Rule 14a-8. After the SEC issued its proposed rule on November 5, 2019, we examined how it would have affected recent proposals and engagements at companies with high profile corporate responsibility challenges: Boeing, Wells Fargo and Chevron.

THE ATTACK ON SHAREHOLDER RIGHTS

KEN BERTSCH

Executive Director, Council of Institutional Investors

The currently pending SEC proposals to regulate proxy advisory firms and to limit shareholder proposals together represent the biggest attack on shareholder rights by the SEC since it was created in 1934.

The Council of Institutional Investors (CII) believes Rule 14a-8 is working well. Shareholder proposals make up less than 2 percent of voting items facing investors at U.S. companies, and the number of proposals has, if anything, declined in recent years. The fact that proposals get higher voting support than in earlier decades shows the strength of the process, rather than it being a problem as management lobbyists seem to believe.

SHAREHOLDER PROPOSALS PROVIDE CRUCIAL EARLY WARNING SYSTEM FOR IDENTIFYING RISK

JOSH ZINNER

CEO, Interfaith Center on Corporate Responsibility

For decades, the shareholder proposal process has served as a cost-effective way for corporate management and boards to gain a better understanding of shareholder concerns, particularly those of longer-term shareholders concerned about the sustainability of the companies they own.

SEC PUTTING CORPORATE INTEREST OVER SHAREHOLDERS AND CONSUMERS

FRAN TEPLITZ

Executive Co-Director, Green America

The general public has grown steadily more aware of how corporations affect people and the planet. More companies now offer “green” products and services, make their supply chains more transparent, and have sustainability departments, but there is an acute need for still greater corporate oversight.

The 2020 Proxy Season

This section of the report presents information on the 429 shareholder proposals investors have filed so far for the 2020 proxy season. Additional proposals for spring votes will show up as the season progresses and more are likely to be filed for meetings that occur after June. A total of 55 proposals are included in the aggregate totals but not described in detail since they have yet to be made public by the proponents. The numbers this year are much higher than the 387 filed last year at this time, but the 2019 season was affected by the six-week government shutdown, which included the Securities and Exchange Commission (SEC). As noted above, this year’s season is not likely to be affected by the current rulemaking, but its promise to restrict filings in the future may have prompted more proponent vigor in 2020.

Structure of the report: Information is presented in three main areas—Environment, Social and Sustainable Governance (ESG). A separate section, entitled Conservatives, covers resolutions filed by shareholders on issues that reflect conservative social views. We note how many proposals have been filed in each category, which are now pending, how many have been withdrawn for tactical or substantive reasons after negotiated agreements with companies, and the disposition of challenges to the proposals at the SEC under its shareholder proposal rule. Rule 14a-8 of the 1934 Securities and Exchange Act allows companies to omit proposals from their proxy statements if they fall into certain categories such as dealing with mundane, “ordinary business” issues. (See Appendix on the PP website for details on the rule.)

Analysis in this report focuses on the resolved clauses and how these compare to previous proposals, as well as previous support for resubmitted resolutions and new developments. We pay close attention to the SEC’s interpretations of the omission rules, given new guidance documents from the commission issued in each of the last three years that set out some new approaches from the commission’s Division of Corporation Finance about whether a resolution concerns “ordinary business” or is “significantly related” to company business.

Key information—Within each section, tables present key data: each company, the resolution, the primary sponsor and the estimated month for each company’s 2020 annual meeting if it is pending.

Voting eligibility—To vote on proposals, investors must own the stock as of the “record date” set by the company, about eight weeks before the meeting.

Environmental Issues

As financial markets increasingly take into consideration growing climate change-related risks to businesses, investors have seen their shareholder resolutions on that issue receive more support. At the same time, some common ground has emerged about how companies can respond to increasing risks and opportunities connected to our changing world; this has pushed the number of withdrawn proposals higher. In 2020, activists have offered 64 climate proposals so far. A further 29 resolutions about a variety of environmental management issues address agriculture (including farm animal welfare concerns), water, hazardous materials and waste.

LAWSUITS

In addition to revising proposal requests about GHG goals, proponents also have sued, seeking court decisions that would supersede any SEC no-action letter.

2019: The New York City pension funds went to court in December 2018 after TransDigm challenged its resolution seeking “time-bound, quantitative, company-wide goals for managing green-house gas (GHG) emissions, taking into account the objectives of the Paris Climate Agreement,” and a progress report. TransDigm initially reiterated an argument used in 2018 by EOG Resources to successfully challenge a GHG goals proposal in its challenge to TransDigm. But the NYC funds filed suit seeking a federal court injunction to require inclusion of the proposal. TransDigm ultimately agreed to include the proposal and the case was closed, as the Comptroller’s Office noted in a January 2019 press release.

2020: This year, another proponent, attorney Tom Tosdal of Montana, has a similar lawsuit. His proposal is much more detailed than the NYC version, however, and asks Northwestern to end coal use and start using renewables (see p. 20 ). On Dec. 17, the company contended at the SEC that the proposal concerns ordinary business and is false and misleading. But five days later Tosdal filed suit, seeking an injunction from the U.S. District Court in Montana to require inclusion of the proposal. On Jan. 9, the SEC said it would not respond to the company’s complaint given the pending litigation. (The proposal, the company’s response, the lawsuit and the SEC’s response are available here.) The court threw out the suit and denied the injunction as Proxy Preview went to press.

(The section on Sustainable Governance, p. 57, examines related reporting proposals, which also request more transparency from companies about environmental management at their own operations and in their supply chains, in conjunction with reporting on social issues and related ties to executive compensation as well as board oversight.)

Climate Change

As of mid-February, there were 48 proposals about carbon asset risks and how companies will cope with a carbon-constrained world (including greenhouse gas (GHG) emissions management). Twelve others deal with energy solutions and four are on deforestation. The overall number is down from the levels of 2014-18 but similar to last year.

The context for climate change proposals is quite different from a few years ago, given the Trump administration’s extensive rollback of laws and regulations enacted in the past to curb emissions and reduce harms. Current U.S.political barriers to climate action have given greater urgency to non-governmental efforts to call companies to account and force them to act. Despite widespread destruction from the changing climate, including devastating storms and wildfires and melting icecaps and glaciers, it remains uncertain if U.S. voters feel strongly enough about these issues to bring about change in either Washington or state capitals around the country. Still, last year large mutual funds continued to vote in greater numbers for climate risk disclosure at their portfolio companies, although most still eschew any public pressure on lawmakers.

Proponents: The Ceres coalition coordinates nearly all these proposals, working with its Investor Network on Climate Risk (INCR) and a broad coalition of institutional investors, including many members of the Interfaith Center on Corporate Responsibility (ICCR), the New York City pension funds and some individuals. The proponents support Climate Action 100+, an effort focused on 100 carbon emitters that account for two-thirds of global industrial emissions and 60 more companies the network says will be key to a “clean energy transition.” Climate Action 100+ is backed by 450 institutional investors managing $49 trillion in assets.

RENEWABLE AND EFFICIENT ENERGY

As in the past, most of the proposals that set out possible energy solutions to climate change challenges are about using more renewable energy, often coupled with questions about energy use and energy efficiency. A majority have already been withdrawn after agreements, as this is an area where companies can see immediate, positive bottom-line impacts.

Pending: Just three proposals seeking renewable energy goals are still pending, at HD Supply Holdings, Home Depot and Steel Dynamics. With slight variations, the request is for a report on how feasible it would be to adopt “quantitative, company-wide goals for increasing the... use of renewable energy, energy efficiency, and any other measures deemed feasible by company management to substantially reduce the company’s greenhouse gas (GHG) emissions.” At Home Depot, it says the report could illustrate reduction in “climate change risks associated with the use of fossil fuel-based energy.”

Withdrawals: Proponents have withdrawn renewables proposals at seven companies, noted on the table. In a typical move, Rockwell Automation agreed to assess setting new environmental goals, including possible goals for increasing renewable energy use, and it will provide more disclosure about ESG topics in its 2020 sustainability report.

RENEWABLE ENERGY AND ENERGY EFFICIENCY = CLEAN ENERGY FUTURE

KATE MONAHAN

Shareholder Engagement Manager, Friends Fiduciary Corporation

Over the past several years, investors have increasingly focused on clean energy as a way for companies to mitigate climate risk and take advantage of opportunities as we transition to a low-carbon economy. In the absence of strong legislative action, corporate commitments are crucial in reaching the levels of decarbonization necessary to keep warming under 1.5°C .

SEC action: Two of the withdrawals occurred after SEC challenges. Air Products & Chemicals asserted the resolution was too detailed and thus ordinary business, and the Nathan Cummings Foundation subsequently withdrew after discussions with the company. At Newmont, the withdrawal was for procedural reasons—the proposal arrived past the submission deadline.

In addition, a different new request from an individual investor to ExxonMobil about facilitating electric vehicles seems likely to be omitted. It asks that the company “install electric vehicle rapid-charging facilities in either a fraction of its existing rural service stations, located along major highways, or in specially designed sites.” The company contends at the SEC that the proponent did not substantiate his stock ownership and that it relates to ordinary business since it involves the types of products and services offered for sale.

VERIZON HEEDS SHAREHOLDER CALL TO SOURCE MORE RENEWABLE ENERGY

LESLIE SAMUELRICH

President, Green Century Capital Management

When Green Century first engaged Verizon Communications, the company sourced 2 percent of its energy from renewable sources—and had a goal to increase that amount to 4 percent by 2025.

We thought 4 percent was the wrong number for Verizon, the largest telecommunications company in the country. Starting in 2016, therefore, we sent letters of inquiry and filed shareholder resolutions asking the company to address its climate risks and reduce its carbon footprint. In November 2018, we filed our third shareholder resolution with the company, urging it to increase the pace of its renewable energy commitments and explore how it might reduce its exposure to the material risks associated with the use of fossil fuel-based energy.

Carbon Asset Risk

Half of the carbon asset risk proposals filed this year ask companies about their goals and reporting on efforts to reduce their GHG emissions and plan for a lower-carbon transition—a critical step if companies are to effectively address climate risks and seize related opportunities. Proposals in this vein have been hit by the SEC’s reinterpretation of what constitutes “ordinary business”—the most commonly used exclusion provision of its shareholder proposal rule—following a no-action letter the SEC staff issued in early 2018 allowing EOG Resources to exclude a resolution. The EOG letter found that a proposal about GHG emissions goals was “micromanagement,” a long-established matter of ordinary business, but not one previously applied to emissions. Proponents in 2019 therefore tried several new formulations to get past this new blockade, asking more generally for reports on company carbon footprints and goals in line with the Paris climate accord’s aims of keeping warming below 2 degrees Celsius. The SEC reiterated the EOG “micromanagement” approach at three companies and three others were omitted for other reasons. But other companies did not challenge similar proposals last year and eight votes averaged nearly 35 percent support, while proponents withdrew seven after reaching agreements. Support for GHG goals proposals has grown from an average of about 24 percent in 2010.

Almost all the 2020 proposals on emissions management and transition planning refer to the Paris treaty as in past years. Only a couple ask for “company-wide, quantitative, time-bound targets,” the EOG stumbling block. Many also seek information or goals on how companies will limit warming to “well below 2 degrees.” As of mid-February, the SEC had rejected one of 11 no-action requests and 19 proposals were pending. (See table.)

CLIMATE ACTION 100+ TARGETS THE 100 LARGEST CORPORATE GHG EMITTERS

MORGAN LAMANNA

Senior Manager, Investor Engagements, Ceres

ROB BERRIDGE

Director, Shareholder Engagement, Ceres

The global investor initiative Climate Action 100+ involves more than 450 investors with a combined $49 trillion in assets under management. Investors engage with the 100 largest corporate greenhouse gas (GHG) emitters, as well as with 60 other influential companies positioned to drive the low-carbon transition. The initiative’s focus companies are collectively responsible for more than two-thirds of global GHG emissions and through engagement investors already have achieved emissions reductions commitments from numerous companies, including BHP Billiton, Daimler, Duke Energy, Heidelberg Cement, Nestle and VW.

GHG Emissions Management

The NYC pension funds resubmitted their 2019 proposal to TransDigm seeking adoption of “a policy with time-bound, quantitative, company-wide goals for managing” GHG emissions and to report. This earned nearly 35 percent in 2019 after an SEC challenge and related lawsuit (see box page 14). Investors will vote again on March 24.

At Halliburton and Williams, the NYC funds have withdrawn a proposal that asked for disclosure of “any medium- or long- term quantitative goals” for managing” GHG emissions and a report on how each “plans to achieve its goals, and whether the goals” take into account the Paris goals. Three additional recipients are not yet public.

Methane is the issue at Spire, where As You Sow withdrew a proposal after dialogue with the company. That proposal sought a report on “what, if any, enhanced measures it is taking beyond regulatory requirements and pipeline replacement to reduce its system-wide methane emissions.”

Transition Planning

Sixteen resolutions ask companies about reporting or taking action to move their companies to Paris compliance, with a variety of formulations.

Pending: Twelve proposals from responsible investing firms and Mercy Investments are pending and ask the following:

As You Sow wants five companies each to report “if, and how, it plans to reduce its total contribution to climate change and align its operations and investments with the Paris Agreement’s goal of maintaining global temperature rise well below 2 degrees Celsius.” That proposal is at Chevron, Devon Energy, ExxonMobil and Hess. The group also wants Hertz Global Holdings to report on “potential climate change mitigation strategies available for reducing the significant carbon footprint of its vehicle rental fleet.”

Trillium Asset Management also asks Chipotle and J.B. Hunt Transport “if, and how” each “plans to reduce its total contribution to climate change and align its operations” with the Paris goal. Last year, Trillium’s proposal asking for adoption of a such a GHG goal was omitted on ordinary business grounds.

Looking at retail companies, Jantz Management wants Dollar Tree and Ross Stores to report within a year on the alignment of “long-term business strategy with the projected long-term constraints posed by climate change.”

Mercy Investments wants Marathon Petroleum to “develop a strategy to increase the scale and pace of the Company’s efforts to reduce its contribution to climate change, including establishing any medium- and long-term goals...with an eye toward” the Paris commitments.

James McRitchie, who mostly files corporate governance resolutions but in the last couple of years has branched out into environmental and social issues, wants Union Pacific to re-port using the same “if and how” formulation employed by As You Sow. Zevin Asset Management asks the same thing of United Parcel Service.

SEC action: Three proposals from the Dutch-based collaborative Follow This are fairly prescriptive, filed at oil supermajors Chevron, ConocoPhillips and ExxonMobil, with slightly different formulations asking for “alignment of strategy” with “well below 2 degrees C” warming that is the Paris aim, including goals for all direct and indirect GHG emissions. But each company is asserting at the SEC that the proponent missed procedural requirements (proof of stock ownership at all three and receipt past the deadline at Conoco). These types of company complaints often succeed.

In addition to the procedural challenges on the Follow This proposals, another eight proposals have been challenged at the SEC. Companies argue that the resolutions either concern ordinary business (ExxonMobil, Hess, J.B. Hunt and Ross Stores) or that current company reporting makes the resolutions moot (Exxon and Hess).

The SEC has disagreed that the J.B. Hunt resolution concerns ordinary business, although the company noted in its challenge that a 2019 proposal asking it to set greenhouse gas emissions goals was omitted for this reason; the same proposal went to a vote in 2018 at the company, earning 21.4 percent support.

Withdrawal: As You Sow withdrew at General Electric after the company lodged a challenging saying a new report, to be released in January, would make the proposal moot.

Strategy and Risk Disclosure

After proposals in 2017 and 2018 requested that companies provide reports on how they will adjust their operations to a world retooled for a 2-degree warming scenario that necessarily would impose constraints on emissions, companies are providing these reports now in large measure, prompted both by the high votes on those proposals and by the recommendations of the Taskforce on Climate-related Financial Disclosure (TCFD). Such scenario reporting is a central tenet of the TCFD and is backed by trillions in global investment support as well as the imprimatur of the Financial Stability Board. Still, this year As You Sow and two individual investors are asking several utilities to report on stranded asset risks—a similar issue—and another individual wants corporate support for a carbon pricing model. All the pending resolutions face SEC challenges.

Pending: As You Sow wants Dominion Energy, Sempra Energy and Southern each to report on how they are “responding to the risk of stranded assets of planned natural gas-based infrastructure and assets as the global response to climate change intensifies.”

An individual investor—Robert Andrew Davis—wants PNM Resources to report on “how it is responding to the risk of stranded assets of natural gas-based infrastructure as the global response to climate change intensifies.” Similarly, Stewart W. Taggart has filed a detailed resolution at Cheniere Energy, asking for a report:

discussing price, amortization and obsolescence risk to existing and planned Liquid Natural Gas capital investments posed by carbon emissions reductions of 50% or higher applied to Scope Two and Scope Three emissions by 2030 (in line with the Paris Accord’s 2C target) as well as ‘net zero’ emissions targets by 2050, also called for in the Paris Accord and what the company plans to do about managing this risk.

Further, Chevron and ExxonMobil face a proposal from Clark McCall, asking each to:

support a pricing structure on fossil fuels that will lead to significant reduction in production of carbon dioxide. Such a pricing structure would be of the type in the 2019 U.S. House bill HR763—$15 fee per metric ton fee of carbon dioxide equivalent at the introduction and increasing by $10 per ton each year—or a similar pricing structure.

SEC arguments: Dominion, Sempra and Southern all are arguing at the SEC that the resolution is moot given their current disclosures, while Dominion adds that it concerns ordinary business since it is about its product offerings and is too prescriptive. Cheniere says its detailed proposal is too vague and is ordinary business, while PNM says its proposal is moot. Chevron and Exxon say the carbon pricing proposal is too detailed and therefore ordinary business, while Exxon adds that it also is moot.

Withdrawal: As You Sow withdrew at Duke Energy after reaching an agreement.

NATURAL GAS IN THE POWER SECTOR: BRIDGE FUEL OR A STRANDED ASSET?

LILA HOLZMAN

Energy Program Manager, As You Sow

As the window of opportunity to prevent catastrophic climate change narrows, natural gas has been lauded by many in the power sector as a “bridge” from high-carbon coal to a low-carbon future. Indeed, gas has been an important step on the path of reducing greenhouse gas emissions and helping to move the power sector away from coal. However, natural gas is still a fossil fuel that generates considerable climate impacts, both through methane leakage across the supply chain from production to use, as well as direct combustion emissions. To achieve a safe level of climate stabilization and to protect investor portfolio exposure from global climate risks, the bridge of natural gas and its associated emissions must have a clear end.

Extreme Weather

A new resolution from As You Sow last year asked oil and chemical companies about potential petrochemical contamination following extreme storms induced by climate change. It is back with the same resolution this year, newly filed at Chevron and Phillips 66; the resolution earned 25 percent last year at ExxonMobil. The proposal asks the companies to assess “the public health risks of expanding petrochemical operations and investments in areas increasingly prone to climate change-induced storms, flooding, and sea level rise.”

Coal, Oil and Gas

A few new resolutions in 2020 ask for action on coal and reports on its use as well as on oil and gas production. All six are currently pending and two have been challenged at the SEC.

The Sierra Club has a new proposal at Ameren for a report, “evaluating the specific financial risks to shareholders should the costs of self-scheduling be disallowed by the Missouri Public Service Commission and those market losses are shifted from ratepayers to shareholders, or should another regulator such as FERC or MISO were to penalize Ameren for such practices.” The company is arguing at the SEC that it can be omitted on ordinary business grounds since it deals with regulatory compliance and current regulatory proceedings.

At Duke Energy, As You Sow again wants a report on how the company “will mitigate the public health risks associated with Duke’s coal operations in light of increasing vulnerability to climate change impacts such as flooding and severe storms. The report should provide a financial analysis of the cost to the Company of coal-related public health harms, including potential liability and reputational damage.” The proposal earned 41.7 percent last year after a similar coal risk report received 27.1 percent in 2018; they were prompted by a 2014 coal ash spill on the Dan River and breaches of coal ash waste ponds following hurricanes in North Carolina.

Coal is also the issue at PNM Resources, in a resubmission from Dee Homans that asks for a report that will “identify and reduce environmental and health hazards associated with past, present and future handling of coal combustion residuals and how those efforts may reduce legal, reputational and financial risks to the company.” The resolution received 7.8 percent support last year.

Another new and detailed resolution on coal is at the utility from individual proponent Thomas Tosdal asks the company “to cease coal fired generation of electricity from the Colstrip plant and replace that electricity with non-carbon emitting renewable energy and 21st century storage technologies with its own assets or from the market no later than the end of the year 2025, and to share that plan with the shareholders no later than the 2021 annual meeting.” It notes supporting documents “are found at 350montana.org.” As discussed above (box, p. 14), Tosdal filed suit to require inclusion of the proposal, an unusual move also taken last year by the NYC pension funds, and because the suit was pending the SEC declined to opine on the company’s assertion that the proposal is too detailed (and thus ordinary business) as well as false and misleading.

At JPMorgan Chase, Trillium Asset Management faces a challenge from the company to its resolution seeking a report on energy production in the far North. It asks that the report describe how the company will “respond to rising reputational risks for the Company and questions about its role in society related to involvement in Canadian oil sands production, oil sands pipeline companies, and Arctic oil and gas exploration and production.” But the bank is arguing at the SEC that resolution is too detailed; the commission agreed with a similar argument last year.

Another new proposal looks to a different part of the world. Proxy Impact and the Pension Board - United Church of Christ want Noble Energy to report on “the extent of potential environmental and public health impacts in the event of major spills or breaches at its Israel offshore drilling operations including an assessment of the magnitude of related financial, operational and reputational impacts on our Company.” The proposal raises concerns regarding the company’s natural gas drilling off the coast of Israel, and related pollution, safety, security and health issues, particularly in light of the highly controversial decision to relocate its Leviathan production platform from 75 miles offshore to just six miles offshore.

Carbon Finance As You Sow and the Presbyterian Church (USA) are reprising questions about financing carbon-intensive projects and reporting on carbon footprints at six banks:

The proposals to Bank of America and Community Trust Bancorp want a discussion of “the range of risks associated with maintaining...current levels of carbon-intensive lending.” At JPMorgan Chase a more detailed request is for disclosure on “how it intends to reduce the GHG emissions associated with its lending activities in alignment with the Paris Agreements goal of maintaining global temperature rise below 1.5 degrees Celsius.”

At Goldman Sachs, Morgan Stanley and Wells Fargo, the proposal is to provide information “on whether, how, and when” each “will begin measuring and disclosing the greenhouse gas footprint of its lending activities.”

BIG BANKS MUST TAKE RESPONSIBILITY FOR THEIR OWN CLIMATE FOOTPRINTS

DANIELLE FUGERE

President, As You Sow

As climate-related harm accelerates, economy-wide losses are increasing and posing growing risk not only to the individual companies in which shareholders invest but, significantly, to their entire portfolios. A 2018 analysis in Nature found that limiting global warming at 1.5°C versus 2°C will save $20 trillion globally by 2100. Failure to maintain warming below 2°C will cost the economy vastly more.

SEC action and withdrawal: JPMorgan is arguing the proposal is ordinary business since it addresses products sold by the company; last year As You Sow withdrew a similar proposal after a similar SEC challenge. Community Trust has lodged a procedural challenge. But As You Sow withdrew at Wells Fargo after the company said an imminent report would make the resolution moot.

Deforestation

Four proposals address deforestation and its connection to climate change. All are at food companies and seek information on commodity supply chains.

Pending: Just two resolution about deforestation are still pending. Green Century wants Bloomin Brands, which owns Outback Steakhouse, to report “assessing how the company could increase the scale, pace, and rigor of efforts to mitigate supply chain greenhouse gas emissions, inclusive of deforestation and land use change.” A similar resolution from SumOfUs is pending at Yum Brands, asking it to provide annual report “on how the company is curtailing the impact on the Earth’s climate caused by deforestation in YUM’s supply chain. The report should include quantitative metrics on supply chain impacts on deforestation and progress on goals for reducing such impacts.” A deforestation proposal at the company asking for sustainably sourced palm oil, soy, beef and pulp/paper earned 32 percent support at Yum last year.

Withdrawn: Green Century withdrew at Archer Daniels Midland after asking the company to report on “metrics regarding its supply chain impacts on deforestation, demonstrating any progress toward reducing such impacts.” No details on the agreement are yet available. But Tyson Foods made a commitment that prompted Green Century to withdraw a similar resolution, after it appeared in the proxy statement.

SEC action: Yum has challenged the proposal, arguing current reporting makes it moot.

Environmental Management

Proposals about environmental management that go beyond direct climate impacts relate to the use of animals and chemicals in the industrial food supply chain, waste (including recycling) and hazardous materials (including plastics) and water.

Waste & Hazardous Materials

Plastics: An effort to get companies to increase their reporting and better manage plastics production that began last year continues, at an expanded list of companies. The proponents are As You Sow and Trillium Asset Management.

• At Huntsman, Occidental Petroleum, Westlake Chemical, the proposal requests a report on plastic pollution that would “disclose trends in the amount of pellets, powder or granules released to the environment by the company annually, and concisely assess the effectiveness of the company’s policies and actions to reduce the volume of the company’s plastic materials contaminating the environment.” It remains pending at Occidental and Westlake.

THE BEVERAGE RECYCLING CONUNDRUM

MARY JANE MCQUILLEN

Head of Environmental, Social and Governance Investment, ClearBridge Investments

The beverage container touches many industries, upstream and downstream, and presents logistical and environmental challenges at each step. ClearBridge takes a life cycle approach to the beverage container’s challenges, finding that there are several entry points for action that can reduce environmental impact.

At Republic Services the pending request is for an explanation of how it “can increase the scale and pace of its efforts to increase plastics recovery and recycling to address environmental problems caused by plastic pollution.”

Plastic bags are the concern at Walmart, where the proposal asks for a report “assessing the environmental impacts of continuing to use single-use plastic shopping bags.”

Withdrawals—Trillium Asset Management withdrew a resolution similar to the one at Republic Services, adding that it wanted information on “constructive” support for “public policy and industry solutions.” The group reached agreements at Sonoco Products and Waste Management, which will expand its reporting to include a nationwide analysis of the generation of and demand for recyclable plastic material, a report on the efficiency of the company’s recycling facilities, and an updated public policy discussion.

STARBUCKS SIGNALS HISTORIC SHIFT FROM SINGLE-USE CUPS AND PLASTICS TO REUSABLE PACKAGING

CONRAD MACKERRON

Senior Vice President, As You Sow

An estimated eight million tons of plastics are swept into oceans annually. Plastic beverage containers are among the most common items found in beach cleanups. In 2008, Starbucks pledged that, by 2015, it would serve 25 percent of beverages in reusable containers like ceramic mugs. Ten years later, the company had little to show for its efforts, with less than 2 percent of beverages served in reusable cups.

SEC action—Huntsman successfully challenged the proposal at the SEC, which agreed the proponent failed to substantiate stock ownership.

Packaging: Other resolutions also concerned with plastics more specifically address packaging.

Pending—A seventh-year resubmission at Kroger asks for a report on an assessment of “the environmental impacts of continuing to use unrecyclable brand packaging.” Similar resolutions earned 38.9 percent in 2019 and 29.4 percent in 2018. At Yum, where As You Sow has a long history, a resubmitted proposal that earned 33.6 percent last year asks for a report “detailing efforts to achieve environmental leadership through a comprehensive policy on sustainable packaging.”

Withdrawals—Trillium Asset withdrew a request to CVS to report on “discussing if, and how, it can further reduce its environmental impacts by increasing the scale and pace of its sustainable plastic packaging initiatives.” The company will identify the amount and types of plastic used in its packaging, as well as their recyclability. CVS also is collaborating with industry partners to address various aspects of the plastic pollution problem. Further, Starbucks agreed to take further action on plastics, having been asked to report on cutting its environmental impact “stepping up the scale and pace of its sustainable packaging initiatives.” Similar proposals earned 44.5 percent support in 2019 and 29 percent in 2018.

Food: JLens is back at Amazon.com seeking an annual report “on the environmental and social impacts of food waste generated from the company’s operations given the significant impact that food waste has on societal risk from climate change and hunger.” It earned 25.9 percent last year. The resolution draws a connection between food waste, reducing GHG emissions and providing food redistribution options; it survived an SEC challenge last year.

Chemical footprint: Trillium has a new proposal to TJX, asking for a report on “describing if, and how, it plans to reduce its chemical footprint.” The body of the proposal discusses “the costs of environment chemical exposure to the health of the global economy” and references a 2017 report that suggests such exposures “likely exceed 10 percent of global GDP or 11 trillion dollars.” It goes on to delineate serious harms, notes new restriction on hazardous materials and asserts that toxic chemicals “present systemic portfolio risks to investors.” Trillium claims competitors such as Walmart, Target and Dollar Tree have set public goals on the subject, but that TJX has not. It wants to see a new policy, lists of priority chemicals, more effort to identify chemicals and mitigate risks and investment in “safer alternatives.”

A LIGHTER CHEMICAL FOOTPRINT SOUGHT FOR CONSUMER GOODS, HEALTH CARE, TECHNOLOGY SECTORS

MARK S. ROSSI

Executive Director, Clean Production Action

ALEXANDRA MCPHERSON

Consulting Program Manager, Investor Environmental Health Network

Materiality of chemicals in products is well established in the Sustainable Accounting Standard Board’s (SASB) standards for Consumer Goods, Health Care, and Technology & Communications. These standards reflect rising demand from consumers and institutional purchasers for safer products and growing evidence of the harmful effects of toxic chemicals, including a peer-reviewed study showing that toxic chemicals cost the world 10 percent of annual global gross domestic product, $11 trillion a year in disease burdens. Yet companies in these sectors have been slow to assess and reduce the chemical footprint of their products.

Agriculture

Nine proposals raise questions related to agriculture; these concern antibiotics used in food production and pesticides, in addition to a resubmission about alternative protein development. Three are not yet public.

Antibiotics: Walmart investors may get to vote on a proposal seeking a report “assessing strategies to strengthen the company’s existing supplier antibiotic use standards, such as prohibiting or restricting the routine use of medically important antibiotics by meat and poultry suppliers, and assess the costs and benefits to public health and the company compared to current practice.” Also still pending is a resolution to Wendy’s for a report “providing quantitative metrics demonstrating progress, if any, toward phasing out the routine use of medically important antibiotics in the company’s beef and pork supply chains.”

REGENERATIVE AGRICULTURE TAKES ROOT AMONG FOOD MANUFACTURERS

CHRISTY SPEES

Environmental Health Program Manager, As You Sow

Food manufacturers have a critical role to play in sustainable food systems. As major purchasers of commodity crops, these companies wield immense power to shift the way food is grown. Some, such as Kellogg and General Mills, are starting to use that power to drive positive change after persistent shareholder pressure.

Withdrawals—Two similar proposals will not go to votes:

As You Sow withdrew at Costco Wholesale a request for metrics about any “progress toward phasing out the routine use of medically important antibiotics in the company’s private label meat and poultry supply chains.” Costco had argued at the SEC that the resolution dealt with ordinary business by dint of micromanagement and was moot.

Green Century withdrew a Hormel after it agreed to provide annual reporting in its use of medically important antibiotics for swine raised on company-owned farms, with the first report in the next year. It also will start a pilot program to tracking use of these drugs with some contract farms, continue discussions with the proponents and continue to work with industry peers.

Pesticides: As You Sow reached an agreement at Kellogg after asking it to provide “available quantitative metrics on pesticide use in the company’s supply chain.”

Alternative protein: A resubmission to Kraft Heinz asks for a report on the company’s “long-term strategy towards protein diversification within its product catalogue.” It earned just 3.2 percent last year.

Water

A new proposal to Baker Hughes, Diamondback Energy, Entergy and Halliburton asks for a report “using quantitative indicators where appropriate any policies and practices to reduce climate related water risk and prepare for water supply uncertainties associated with climate change.”

2020 COULD BE PIVOTAL YEAR FOR SUSTAINABILITY ACCOUNTING STANDARDS

PAUL RISSMAN

Co-founder, Rights CoLab

The Sustainability Accounting Standards Board (SASB) was formed in 2011 to formulate social and environmental disclosure standards in line with definitions of financial materiality under U.S. securities laws. Financial materiality is a critical feature from the standpoint of mainstream investors, as many of them construe their fiduciary responsibilities to mean that any engagement or voting effort directed toward ESG issues must have monetary benefits for their customers.

Another from As You Sow at Sanderson Farms was far more detailed:

in order to allow tracking of water stress trends and impacts that are expected to be exacerbated by climate change, the Board of Directors report to shareholders on quantitative metrics identified by the Sustainability Accounting Standards Board (SASB) as providing material information on water resource risks for the Meat, Poultry and Dairy sector by 180 days after the 2020 Annual Meeting, at reasonable expense and excluding confidential information, and annually thereafter, including:

Total water withdrawn, and percentage in regions with High or Extremely High Baseline Water Stress;

Percentage of contracts with producers located in regions with High or Extremely High Baseline Water Stress;

Percentage of animal feed sourced from regions with High or Extremely High Baseline Water Stress.

The issue was last raised at the company in 2016, when a proposal seeking a water stewardship policy earned 27.4 percent support. This time around, it received just half that—11.1 percent. Management said it is dedicated to water stewardship and that it reports to investors on its initiatives and practices through its Corporate Responsibility Report and its response to the CDP water questionnaire, although it did not actually report to CDP.

As You Sow invoked the Sustainability Accounting Standards Board (SASB) standards in a resolution at Skyworks Solutions that asked for a report on “water management risks” that consider the standards SASB set out for the semiconductor industry. The group withdrew after reaching an agreement with the company.

Finally, Mercy Investments wants Pilgrim’s Pride to report by December “assessing if and how the company plans to increase the scale, pace, and rigor of its efforts to reduce water pollution from its supply chain.”

Social Issues

Click below to go to the next (or previous) section.

Animal Welfare

Only three proposals about animal welfare issues have surfaced so far in 2020 and it is not clear any will go to a vote. Harrington Investments wants TJX to “commission an independent analysis of any material risks of continuing operations without a company-wide animal welfare policy or restrictions on animal-sourced products associated with animal cruelty.” It says the report “should assess the operational, reputational and financial implications of the company’s vendor policies pertaining to oversight on animal welfare throughout the supply chain.” The company is arguing at the SEC that it concerns ordinary business given its focus on fur, a specific type of product, an argument that has succeeded at other companies in the past.

People for the Ethical Treatment of Animals (PETA) has two resolutions but already has withdrawn one at its longtime foe, SeaWorld Entertainment, which asked the company “to address the most pressing issue that Sea World faces today—the public’s continued opposition to captive-animal displays—the shareholders urge the board to stop allowing trainers to stand on dolphins’ faces and ride on their backs in exploitative and potentially harmful circus-style shows.” The company lodged a multi- pronged challenge at the SEC and the withdrawal came before any commission response, although the company also clarified in a letter to PETA that it plans to end the use of dolphins to which it objected. PETA has proposed several other resolutions about the company’s use of marine mammals in the past and most have been omitted on ordinary business grounds.

One remains pending at Marriott International but also appears to be vulnerable to an ordinary business challenge. It encourages the company “to prohibit wild-animal displays at all its hotels because such exhibits are cruel, promote an abusive industry, and pose a safety risk to the public.” Marriott contends it is too detailed and not significantly related to its business.

Corporate Political Activity

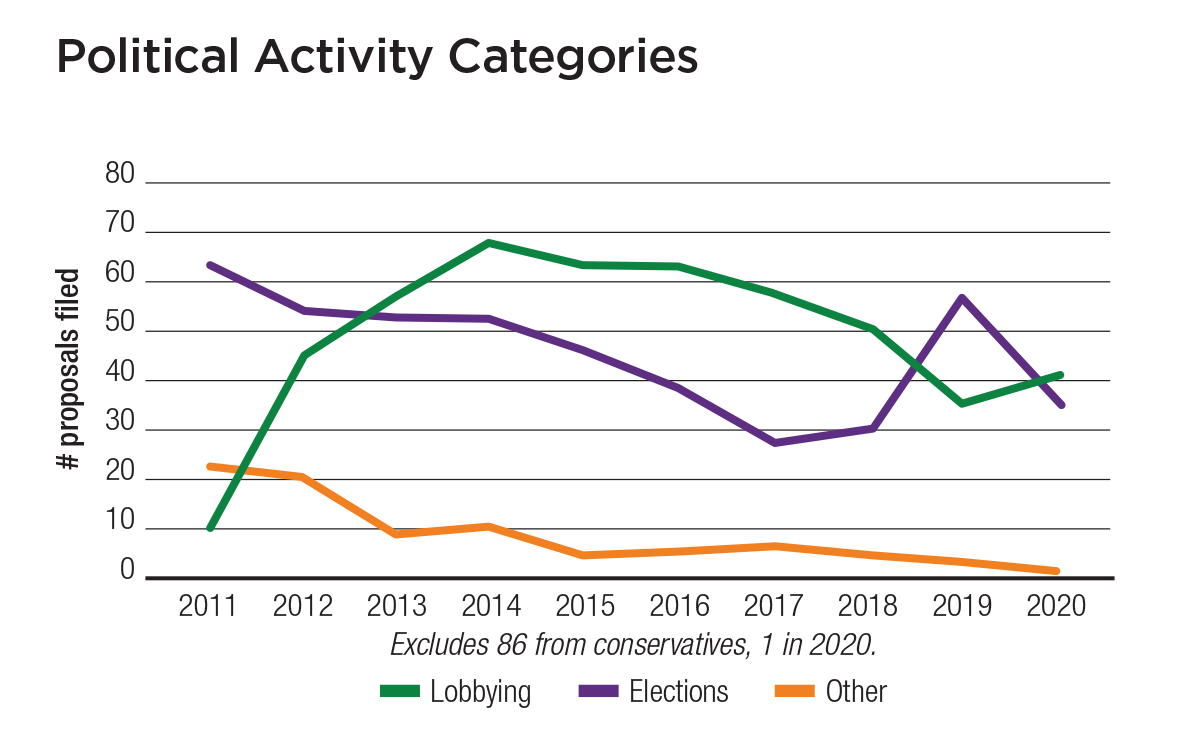

The volume of proposals filed about corporate political activity—election spending and lobbying, as well as other corporate influence issues—is down from a high point in 2014, but remains the biggest single topic of shareholder resolution interest, as it has for many years. High-scoring proposals about lobbying and election spending would be significantly affected by the proposal changes to the Shareholder Proposal Rule, as discussed in the introduction to this report (see p. 11). Proponents have filed 77 proposals thus far, down from 93 at this point in 2019, and around the same level as the previous two years. Last year saw a bump-up in election spending resolutions, but in 2020 lobbying is again transcendent; each of these main types seek more oversight and disclosure. (Only a few other issues about political activity come up, as noted on the graph next page.) Proponents are less likely to withdraw proposals on political spending. (See graph right.)

In response to the campaigns for more corporate accountability, a growing number of companies now have oversight in place, but most remain reluctant to disclose expenditure amounts in public reports for investors, as requested, and very few are willing to report on money they give to trade associations that makes its way into the political system, through “dark money” channels that shield funders and play an outsized role in elections and policymaking.

Proponents include social investment and religious organizations, leading pension funds such as the New York City’s and the New York State Common Retirement Fund (NYSCRF), trade unions and some individuals. Investor concern about corporate election spending began in 2003 with the advent of the Center for Political Accountability (CPA) and intensified after the Citizens United U.S. Supreme Court decision in 2010. The CPA’s model oversight and disclosure approach is the standard template for lobbying transparency, too, and forms the basis for the lobbying disclosure campaign run by Boston Trust Walden and the American Federation of State, County and Municipal Employees (AFSCME). The umbrella Corporate Reform Coalition supports shareholder activity on corporate spending and includes other reformers.

Key references for investors are the CPA’s CPA-Zicklin Index, most recently updated in October 2019, covering the S&P 500. The Conference Board’s Committee on Corporate Political Spending offers a more corporate but generally supportive perspective on accountability, but has had little recent activity.

Multiple proposals: Since 2013, proponents have been able to file separate election spending and lobbying proposals at the same company; before that the SEC judged them to be too similar and allowed the omission of the second one received. This year, only Duke Energy, ExxonMobil and Nucor have both.

Conservative “free market” proponents have borrowed the resolved clauses written by disclosure advocates, in successful efforts to block the main campaign proposals, since SEC rules still allow the exclusion of the second-received proposal on the same subject. While the supporting statements make clear the different goals of the proponents of the two types of proposals, investors do not seem to differentiate between the two in their voting. This year, one omission at Chevron has occurred so far because of such a competing conservative proposal. (See Conservatives, p. 66.)

Lobbying

The lobbying transparency campaign is coordinated by Boston Trust Walden and the American Federation of State, County and Municipal Employees (AFSCME).

Primary resolution: The resolved clause for the main lobbying campaign resolution remains the same and was filed at 41 companies (see table for a full list). Eighteen are resubmissions, 10 of which had seen a vote increase last year from earlier. Two filed this year would not have been eligible under the proposed new SEC rule since they did not receive at least 25 percent support; Ford Motor’s third-year proposal received 16.5 percent and Tyson Foods’ earned 11.2 percent in its fourth year (it already has gone to a vote this year, getting 14.7 percent). At both companies, founding family ownership always produces votes that are lower than is typical for an issue.

The main proposal asks for an annual report that includes:

Company policy and procedures governing lobbying, both direct and indirect, and grassroots lobbying communications.

Payments by [the company] used for (a) direct or indirect lobbying or (b) grassroots lobbying communications, in each case including the amount of the payment and the recipient.

[The company’s] membership in and payments to any tax-exempt organization that writes and endorses model legislation.

Description of the decision-making process and oversight by management and the Board for making payments described in sections 2 and 3 above.

For purposes of this proposal, a “grassroots lobbying communication” is a communication directed to the general public that (a) refers to specific legislation or regulation, (b) reflects a view on the legislation or regulation and (c) encourages the recipient of the communication to take action with respect to the legislation or regulation. “Indirect lobbying” is lobbying engaged in by a trade association or other organization of which [the company] is a member.

Both “direct and indirect lobbying” and “grassroots lobbying communications” include efforts at the local, state and federal levels.

The report shall be presented to the Audit Committee or other relevant oversight committees of the Board and posted on [the company]’s website.

Votes—Investors at Tyson Foods gave the proposal 14.7 percent in February. Other early votes will occur at Maximus on March 17 and Walt Disney on March 11.

COULD LOBBYING DISCLOSURE AT BOEING HAVE PREVENTED OVERSIGHT LAPSES THAT LED TO FATAL CRASHES?

JOHN KEENAN

Corporate Governance Analyst, AFSCME Capital Strategies

Boeing is one of the biggest corporate spenders on federal lobbying, spending over $166 million since 2010, and Boeing’s reputation and financial health remain at serious risk in the wake of two fatal crashes of its 737 MAX.

Withdrawals—So far, proponents have withdrawn four proposals after reaching agreements, at AES (a new recipient), BlackRock (21.7 percent in its third year in 2019), CenturyLink (36.2 percent in its third year) and Nucor (36.2 percent in its third year).

SEC action—As noted above, the proposal at Chevron has been pushed aside in favor of one from the conservative National Center for Public Policy Research. The SEC did not agree with a challenge from Walt Disney that its proposal was moot. Still awaiting a response from the SEC is a GEO Group challenge that says its resolution from SEIU is ordinary business, is moot and relates to the union’s complaints with the company and not broader shareholder concerns.

Climate-related advocacy: Four new proposals from one of the world’s largest banks, BNP Paribas, reiterate investors’ concerns about corporate efforts to specifically influence public policy about climate change, creating two political resolutions at Chevron, ExxonMobil and United Continental Air Lines—as well as one more at Delta Air Lines. The proposal asks for a report

within the next year...describing if, and how, [the company’s] lobbying activities (direct and through trade associations) align with the goal of limiting average global warming to well below 2 degrees Celsius (the Paris Climate Agreement’s goal). The report should also address the risks presented by any misaligned lobbying and the company’s plans, if any, to mitigate these risks.

SEC action—Exxon has challenged the proposal at the SEC, arguing that it duplicates the other resolution about lobbying that it received first; a withdrawal therefore seems likely.

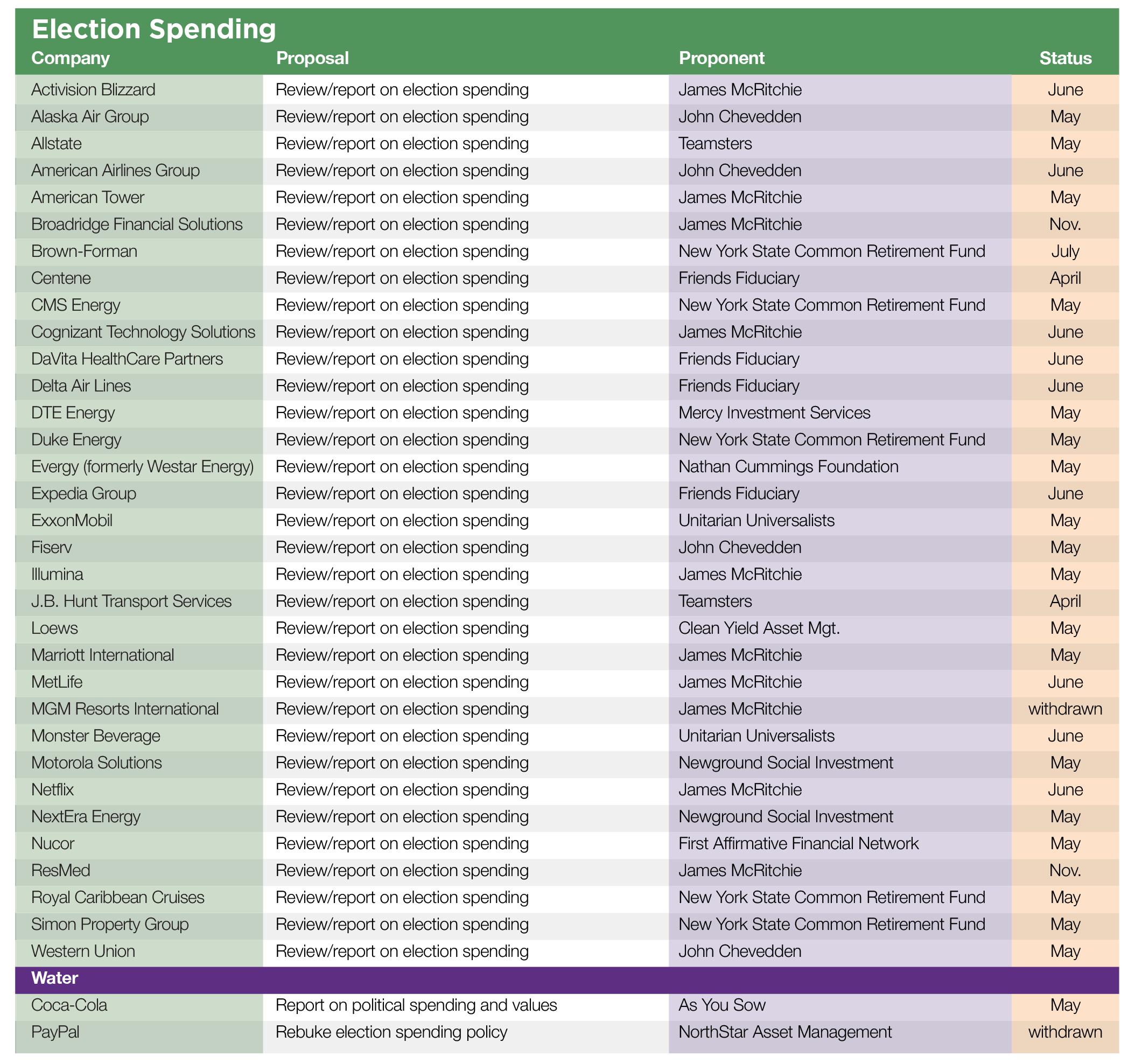

Election Spending

The Center for Political Accountability and its allies, a wide variety of institutional investors, continue to seek board oversight and transparency about election spending from corporate treasuries, with 34 proposals filed this year. Nearly two-thirds (20) are resubmissions, 14 of which were first proposed last year. (See table for the full list.) Support from investors for these resolutions has continued to climb and averaged 36.2 percent last year, a big jump from earlier. Votes in 2019 included two majorities at Cognizant Technology Solutions (53.6 percent) and Macy’s (53.1 percent) and nine more tallies over 40 percent.

2020: YEAR OF RECKONING FOR COMPANIES ON POLITICAL SPENDING

BRUCE FREED

President, Center for Political Accountability

DAN CARROLL

Vice President for Programs, Center for Political Accountability

As the 2020 proxy season unfolds, this is the moment to assess the real impact of corporate political spending, the heightened risk companies and our society face, and what more needs to be done to address it.

The amount and consequences of company spending shouldn’t be underestimated. The common misperception is that individuals and private companies are the dominant donors. The Center for Political Accountability (CPA) undertook the first look into the sources of money for and the impact of spending by six partisan “527” committees that have reshaped state and national politics over the past decade. They included the Republican and Democratic governors’ associations, state legislative campaign committees, and attorneys general associations. Here’s what we found:

The standard CPA proposal, which has not been changed for several years, asks companies to produce a report, with semiannual updates, on:

Policies and procedures for making, with corporate funds or assets, contributions and expenditures (direct and indirect) to (a) participate or intervene in any political campaign on behalf of (or in opposition to) any candidate for public office, or (b) influence the general public, or any segment thereof, with respect to an election or referendum.

Monetary and non-monetary contributions and expenditures (direct and indirect) used in the manner described in section 1 above, including:

a. The identity of the recipient as well as the amount paid to each; and

b. The title(s) of the person(s) in the Company responsible for decision-making.

Withdrawal: James McRitchie withdrew at MGM Resorts International after the company agreed to adopt the CPA model policy and disclosure. More withdrawals are likely as the season progresses. Last year, proponents reached agreements and withdrew proposals at 13 companies.

SEC action: NextEra Energy is contending that the resolution, in its sixth year, is moot given recent reforms undertaken after the 2019 vote. The proposal has earned increasing levels of support, starting with 39.5 percent in 2015 and reaching 48.7 percent in 2019.

Rebuke: NorthStar Asset Management filed a resolution at PayPal that the company challenged, arguing that it was not a proper shareholder request and also was too vague. It was a new request and criticized the company’s PAC spending. NorthStar withdrew before any SEC response. The resolution said:

Resolved: Shareholders rebuke the Board of Directors at PayPal Holdings, Inc. for failing to have in place adequate measures to ensure that political contributions made by the Company or its PAC are in line with PayPal’s stated values and goals.

One more proposal also addresses congruency between corporate values and political spending, at Coca-Cola. It expresses concern about the company’s efforts to oppose bill requiring bottle deposits to encourage recycling and support for candidates that oppose reproductive health rights. The proposal is a new iteration of earlier calls for values congruency in corporate political spending, aired at other companies and asks that the company publish an annual report on “the congruency of political and electioneering expenditures during the preceding year against publicly stated company values and policies.” (See p. 47 for more on a new campaign from Rhia Ventures on reproductive health rights.)

Decent Work

The number of shareholder resolutions seeking more disclosure about fair pay and working conditions rose sharply after 2014 and has stood at about 50 filings in each of the last two years. Most of the proposals address inequalities connected to race and gender. Women and people of color continue to earn less than their white male counterparts and the campaign to rectify these differences continues. (Workplace diversity is covered separately in this report, p. 42.)

Proposals ask for action to alleviate disparities and provide data about the nature of differential pay. Last year the New York City Comptroller’s Office and trade unions also started focusing on mandatory arbitration and the ways in which it hides sexual harassment and violence in the workplace. (Table, p. 41, lists all the resolutions.)

Many of the decent work proposals have come out of work from a group of 25 large institutional investors called the Human Capital Management Coalition, (HCMC) sponsored by the UAW Retirees’ Medical Benefits Trust, which in 2017 petitioned the SEC to require more disclosure of information about a company’s workforce and human resources policies. Members of HCMC include Trillium Asset Management, the Office of the New York City Comptroller and the AFL-CIO Office of Investment, among others.

Pay Disparity

CEOs: The vast majority of proposals about corporate pay included in this report address disparities that occur for employees based on gender and race. But we also include a few that discuss the vast disparities between pay for CEOs and other employees. The United Steelworkers and Trillium Asset Management have filed the same proposal at 3M and TJX, asking each to

take into consideration the pay grades and/or salary ranges of all classifications of Company employees when setting target amounts for CEO compensation. The Compensation Committee should describe in the Company’s proxy statements for annual shareholder meetings how it complies with this requested policy. Compliance with this policy is excused if it will result in the violation of any existing contractual obligation or the terms of any existing compensation plan.

The resolution earned 10 percent last year at 3M. It is new at TJX, which is arguing at the SEC that it is moot and also concerned with ordinary business; the SEC has yet to respond.

Jing Zhao, the Chinese human rights activist, also asked Apple to “improve guiding principles of executive compensation,” discussing CEO pay disparity in the body of his proposal. But the company persuaded the SEC that it dealt with ordinary business. Zhao has a different resolution at Juniper Networks, asking it to “reduce the CEO Pay Ratio by 5% each year until it reaches 50:1,” but the company contends at the SEC that it also is ordinary business since it is too prescriptive; the SEC has yet to respond.

Walt Disney successfully argued another proposal, from individual proponent Karen Perricone, also related to ordinary business and was too vague. It asked the company to

limit the annual total compensation of our Chairman and Chief Executive Officer to a ratio not to exceed the total annual compensation of Disney’s median employee by more than 500:1. This proposed ratio would be attained within a five year timeframe by decreasing the annual total compensation of our Chairman and Chief Executive Officer and by increasing the annual total compensation of our lowest paid employees.

WHAT PAY RATIO DISCLOSURE CAN TELL US ABOUT DECENT WORK

ROSANNA LANDIS WEAVER

Program Manager, Power of the Proxy, As You Sow

Under a provision of the 2010 Dodd-Frank financial reform bill, companies must disclose the ratio of the pay between the CEO and the company’s median employee. While shareholders had insight into executive compensation under prior rules, this is the first insight into median employee pay. It should not be skimmed as another number amongst so many in a proxy statement but considered for the insight it may offer into decent work.

Gender and race: Arjuna Capital remains the most prolific of the proponents in this area; the New York City Comptroller’s Office is a key player, too, but its 2020 filings are not yet public. Additional proposals on pay equity are from Proxy Impact on behalf of the Women’s Inclusion Project. All but two of the proposals are resubmissions from 2019, when the average for 15 votes on the issue was 26 percent. High votes last year at companies that have resubmissions were at CIGNA (35.6 percent), Adobe (33.3 percent), JPMorgan Chase (31 percent) and Intel (30.3 percent).

Arjuna wants 13 companies (see table 41) to report on global pay disparities. Last year it asked six companies to report on risks associated with public policy about gender pay gaps generally, and six others about the global median pay gap. This year the latter is the request at all companies and adds race to the mix, seeking a report “on the company’s global median gender/racial pay gap, including associated policy, reputational, competitive, and operational risks, and risks related to recruiting and retaining diverse talent.” The proponents state that “Assessing if a company has pay gaps requires analyzing both equal pay and equal opportunity. This is done using adjusted and unadjusted (median) pay data. The objective of this proposal— median pay gap disclosure—addresses the structural bias affecting the jobs women and minorities hold, when white men hold most higher paying jobs.”

IT’S TIME FOR AN HONEST ACCOUNTING OF PAY EQUITY

NATASHA LAMB

Managing Partner, Arjuna Capital

In December 2019, Starbucks became the second U.S. company to disclose the full story of gender and racial pay equity. The retailer disclosed both its “equal pay” gap and its “median pay” gap for women and minority workers. The headline here is that there was no gap on either basis in the United States—a rarity among companies. In fact, Starbucks’ median pay results stand in sharp contrast to the 20 percent gender pay gap for the U.S. workforce and the 30 percent gap for the retail industry.

The United Kingdom mandates disclosure of adjusted and unadjusted (median) pay data, yet with few exceptions, U.S. companies decline to provide unadjusted data. All of the companies facing resolutions (with one exception) assert that median pay is not a useful metric, although this is the key metric used by the Organization for Economic Cooperation and Development, the World Economic Forum and the United States Department of Labor.

As for racial pay gaps, in general, U.S. companies report on domestic racial breakdowns for the United States and gender differentials only (when they discuss them) globally.

Withdrawals—To date, just one of the Arjuna proposals has been withdrawn, at Starbucks; the company agreed to provide the global median pay gap data requested. Arjuna had withdrawn most of its 2018 proposals that focused only on women, asking for reports on “policies and goals to reduce the gender pay gap.” It reached agreements with major banks that year about actions they planned to take to close their pay gaps but was less successful in 2019 with the global data request. Companies proved reluctant to report on worldwide disparities, which are affected by country-by-country pay differentials. Companies have reported on adjusted data that often leaves out 10 percent to 15 percent of a workforce total, including the highest paid positions where the largest discrepancies appear, which is why proponent are now asking for unadjusted data.

Women: Proxy Impact has three proposals similar to Arjuna’s, but only about women, seeking a report “on the company’s global mean and median gender pay gap, including associated policy, reputational, competitive, and operational risks, and risks related to recruiting and retaining female talent.” The proposal is a resubmission at CIGNA, where it earned 35.6 percent last year, the highest 2019 vote on this issue. Proxy Impact withdrew in 2019 at Pfizer when the company said it will hire outside experts to assess in the first half of 2019 whether it has a global gender pay gap and a U.S. race pay gap, and the sources for any gaps, and report publicly on the results by no later than early 2020. Its internal U.S. pay audits have found no gender- or race-based pay gaps, Pfizer said. But Proxy Impact refiled this year, asking just about unadjusted global median pay, since the company has only provided adjusted data so far. The filing is new at Wyndham Destinations.